Why the Helical Rotor Pumps Market Is Pumping Up Growth This Year

Sunday,30 Mar,2025

The Helical Rotor Pumps Market is flowing strong in 2025, driven by a global need for reliable, versatile pumps capable of handling everything from viscous slurries to delicate fluids. Known for their progressive cavity design, these pumps excel in delivering consistent, low-pulsation flow, making them a staple in wastewater treatment, petroleum extraction, and food production. Valued at approximately $3.5 billion in 2023 and projected to reach $5.8 billion by 2032 with a CAGR of 5.5%, the market thrives on innovations in rotor pump technology that enhance durability and efficiency. Yet, as it gains momentum, it faces currents of complexity—sustainability demands, rising material costs, and competition from alternative pump technologies threaten to disrupt its rhythm, creating a dynamic landscape ripe for discussion.

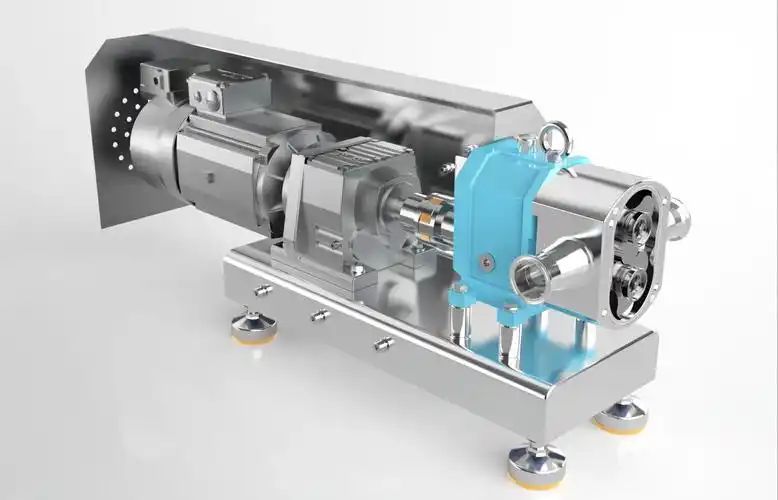

What powers this market’s surge is its adaptability. Helical rotor pumps, with their single helical rotor spinning within a double-helix stator, handle high-viscosity fluids and solids-laden media with ease—think sludge in treatment plants or crude oil in upstream operations. The Helical Rotor Pumps Market dominates in Asia Pacific, where rapid industrialization in China and India fuels a 40% regional share, though North America holds steady with stringent hygiene standards driving food-grade pump adoption.

Rotor pump technology is propelling the Helical Rotor Pumps Market into a new era, with 2025 spotlighting cutting-edge developments. Smart pumps with IoT sensors and AI analytics are slashing downtime by 15%, offering real-time diagnostics for predictive maintenance—ideal for oil rigs or food processing lines. Energy-efficient designs, like low-friction stators and hybrid motors, cut power use by up to 12%, aligning with global sustainability goals like the EU’s Green Deal. Meanwhile, abrasion-resistant materials—ceramic rotors and reinforced rubber stators—extend pump life by 20%, tackling the wear issues plaguing heavy-duty applications.

But these leaps come with caveats. The high cost of advanced rotor pump technology—sometimes $50,000 per unit—puts it out of reach for smaller operators, raising equity concerns. Scaling eco-friendly innovations lags, too, as sustainable materials like biodegradable stators remain pricier than traditional options. This divide could fuel debates: Is the Helical Rotor Pumps Market prioritizing green tech over accessibility, or setting a new standard for fluid handling? Expect this tension to bubble up in industry forums and social media as stakeholders weigh cost versus conscience.

The Helical Rotor Pumps Market is a cauldron of trending issues ripe for engagement. Sustainability is a headliner—regulatory pushes for lower emissions clash with energy-intensive production, spotlighting eco-friendly pumps as a solution, yet their adoption hinges on cost reductions. The rise of smart pumps ties into Industry 4.0, with applications in wastewater (up 10% in urban projects since 2023) and oil extraction promising efficiency, but raising privacy and job loss concerns. Food safety, too, is heating up—hygienic designs for shear-sensitive fluids like sauces are booming, driven by a 12% rise in processed food demand in 2024.

User challenges add pressure. High maintenance costs—stator replacements can hit $5,000 annually—frustrate operators, while raw material volatility (rubber prices up 8% in 2024) squeezes margins. Supply chain delays, like shortages of alloy steel rotors, amplify the pain, a frustration echoed online. These dynamics position the Helical Rotor Pumps Market as a flashpoint for 2025, blending practical woes with policy debates that could dominate trade discussions and digital chatter.

The Helical Rotor Pumps Market is poised for steady growth, but its path depends on adaptability. Scaling rotor pump technology—think affordable smart systems and sustainable materials—could unlock untapped potential in emerging markets like India, where infrastructure spending rose 7% in 2024. Topics like AI-driven pump optimization, green manufacturing, and global regulatory alignment could spark hot articles and policy shifts. In my view, the market’s strength lies in balancing innovation with affordability—its promise risks clogging if it caters only to high-end users.

This isn’t just about pumping fluids—it’s about pumping progress. The Helical Rotor Pumps Market in 2025 is set to redefine industrial efficiency, but it must navigate a turbulent stream of costs and eco-demands. As it charts its course, expect this sector to keep the conversation flowing.

FAQS

Q1: What’s driving the Helical Rotor Pumps Market in 2025?

A1: Growth is fueled by demand for efficient fluid handling in wastewater, oil, and food industries, powered by rotor pump technology advancements.

Q2: How does rotor pump technology shape this market?

A2: Smart systems and eco-friendly designs boost performance and sustainability, though high costs can limit adoption for smaller firms.

Q3: What challenges do users face in this market?

A3: High maintenance costs, material volatility, and supply chain delays hinder affordability and reliability.

Q4: Are there controversial trends impacting the market?

A4: Yes, sustainability mandates and smart pump job impacts could spark debates over eco-goals versus employment.

Q5: What future topics might drive engagement?

A5: AI optimization, green production, and food safety innovations could dominate industry and policy discussions.